USB4 Cable Specifications: The Future of High-Speed Connectivity

Introduction As technology continues to evolve, the demand for faster, more efficient connectivity solutions has become critical for businesses and

China cable assembly suppliers are a great way to get all the materials you need for your company at a lower cost. Many different payment methods can be used when doing business with China’s top suppliers of cable assemblies, but which should you choose? This blog post will help guide you through the process of choosing an appropriate method and explain how long each transaction takes.

This stands for Telegraphic Transfer and it’s a way of quickly and securely transferring money between banks. The entire process, from start to finish, usually only takes two to four business days. There are no fees or chargebacks associated with transactions that use T/T, but each company will have their own specific process to follow. If you’re interested in using this option, make sure your bank account can handle international transactions and has the appropriate currency settings enabled.

PayPal is a very popular payment method for online purchases, and it’s no different when buying cable assemblies from China. Transactions using PayPal are typically very quick and are processed without any additional fees. However, if your supplier does not have a PayPal account or does not want to use it, you may have to cover the cost of any currency conversion fees.

AliPay is China’s own version of PayPal. It was started by the Alibaba Group in 2004 and functions very similar to its American counterpart. AliPay is not only another way to pay for your cable assemblies from china suppliers; it can also be used anywhere else that accepts PayPal payments!

This service is very similar to PayPal and works with most major banks around the world. Transactions are typically completed within minutes, but there may be a small fee associated with each one.

Western Union is one of the oldest forms of money transfer in existence and is still very popular today. This payment method requires that your supplier have a bank account set up with Western Union before you can use it—just tell them to register at any local branch if they’re interested! It’s important to note that there are usually fees associated with using this option, so make sure both parties agree on who covers those costs beforehand.

This option allows you to send money directly to your supplier’s bank account, making it a great choice if you don’t have a PayPal account or want to avoid any potential currency conversion fees. However, keep in mind that this process can take up to five business days and there may be additional charges assessed by both Western Union and your supplier’s bank.

L/C is a more formal payment option that can be used when importing goods from China. An L/C is essentially an agreement between two parties (the buyer and the seller) in which the buyer agrees to pay for goods once they’ve been delivered, inspected, and approved by the seller. The main benefit of this system is that it guarantees payment from the buyer.

This process usually takes around three weeks to complete, but it’s a great way to ensure you’re getting what you paid for! Keep in mind that your supplier will likely require a deposit before starting production, so make sure you have enough saved up beforehand.

Bank/Wire transfer is a popular payment method for businesses when importing goods from China because it’s a relatively fast and efficient way to move money. This option typically takes between two and four business days to complete. Keep in mind that there may be some fees associated with wire transfers, so make sure you discuss those costs with your supplier before committing.

***

International Bank Drafts is a popular choice for businesses because it’s relatively safe and efficient. The entire process usually takes around five business days to complete. There may be some fees involved depending on what bank you use (usually between US$25-$50) so make sure you talk to your supplier first before committing. International Bank Draft is another great way of paying your supplier without worrying about any currency conversion charges or other hidden costs!

Credit cards are an ideal choice when importing goods from China because they’re quick, simple, and secure. The entire process usually takes around two days to complete (depending on exactly where you are in the world). While this option does require some international transactions fees with your supplier’s credit card company, these rates tend to be much lower than those of standard wire transfers. Just make sure you talk over all the details first before committing!

However, despite these drawbacks, credit cards remain one of the most popular ways to pay for goods and services around the world.

Escrow is another popular option that’s often used by businesses importing goods from China. This payment method is safe and relatively fast, with the entire process usually taking around two to four business days to complete (outside of weekends). There are some associated fees depending on your supplier but this system offers an added level of security compared to other methods because it allows you time for transactions before completing them. Just be sure not to sign an official contract until you are absolutely certain all details have been ironed out!

There is no prescribed time of when you should pay your cable assembly supplier. The time to make payments will depend on your agreement with the supplier. Discuss with the supplier about when payments should be done and find out early enough if the supplier has a payment policy in place i.e. requires a deposit.

It is important for businesses wanting to take advantage of China’s low-cost manufacturing industry to know about available payment options when purchasing cable assemblies or other products online. The most common payment methods include PayPal, credit cards, wire transfers through international banks, and online payment systems. Established China cable assembly suppliers like Edom Electronics offer their customers various methods of payments since they deal with clients all over the world. You will enjoy a hassle free payment experience since their support team will advise you on how to make payments easily. We wish you a smooth experience doing business with a Chinese cable assembly supplier!

Introduction As technology continues to evolve, the demand for faster, more efficient connectivity solutions has become critical for businesses and

Understanding the Evolution of USB Connectors In today’s technology-driven world, USB (Universal Serial Bus) connectors are an integral part of

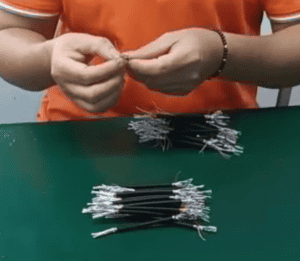

At EDOM Electronics, we take pride in our meticulous approach to manufacturing high-quality USB C to C cables. Today, we’re

WhatsApp us